Some months ago I wrote a blog about how the IRS had improperly applied my estimated tax payments for 2020 to the earliest tax years for which I had an open balance. In that way they wiped out the balance from 2011 and part of it from 2012, thus circumventing the 10 year statute of limitations for collection. I should have gotten beyond the statue with the approximately $1,400 due that year (before interest and penalties).

Misapplying payments is against IRS regulations, and I wrote a letter to the IRS right after receiving the notices asking that my estimated payment be returned to my 2020 Social Security payments. There has been no response to my August 25, 2021, letter, which is no surprise if you’ve seen the recent announcements from the IRS about their ongoing staffing shortages and “paperwork backlogs.” My letter is in some big pile with millions of other letters, returns, and amended returns that have not been processed. “Paper is the IRS’ Kryptonite, and the agency is still buried in it,” says the National Taxpayer Advocate Erin Collins in her annual report to Congress (see David Gross’s summary here).

Misapplying payments is against IRS regulations, and I wrote a letter to the IRS right after receiving the notices asking that my estimated payment be returned to my 2020 Social Security payments. There has been no response to my August 25, 2021, letter, which is no surprise if you’ve seen the recent announcements from the IRS about their ongoing staffing shortages and “paperwork backlogs.” My letter is in some big pile with millions of other letters, returns, and amended returns that have not been processed. “Paper is the IRS’ Kryptonite, and the agency is still buried in it,” says the National Taxpayer Advocate Erin Collins in her annual report to Congress (see David Gross’s summary here).

Recently seven IRS collections letters arrived in one day’s mail delivery, which reminded me of this hanging issue. The letters were for 2012 through 2018, so I realized they had dropped 2011 and never adjusted that estimated payment. I’ve thought of checking that online account the IRS has set up for each of us, and I know some of you look at yours, but somehow I can never get past filling out the personal info to see what they’ve got for me.

Today, just for the heck of it, I tried calling the IRS. I was not hopeful of getting through, and if I were to reach someone, I was not hopeful that they would be helpful. After going through a few rounds of “press this number” now “press this number” I was told my hold would be 30-60 minutes. I decided to hang up and try pressing a different option. Same result. I stuck with the hold for a while. “Calls are answered in the order received. Don’t hang up.” Then after about 10 minutes, “Consider hanging up and check your account online.” After 14 minutes I took the advice about hanging up.

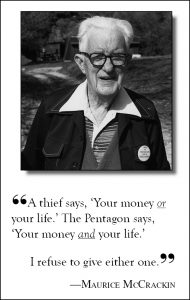

Restored Israel of Yahweh had three members imprisoned for refusing war taxes in 2005 in one of the more rare 21st century cases for war tax resisters. Photo by Ed Hedemann.

It’s at this point when you have to keep reminding yourself why you got into this form of resistance. Since I couldn’t be a draft resister, I became a war tax resister to demonstrate my refusal to participate in war. I want to challenge militarism and military spending. I did expect the consequences to be worse than receiving piles of threatening letters, one summons to an IRS office in 2009, one bank account seizure, and spending 14 minutes on hold with the IRS.

There have been times when war tax resistance in the U.S. has gotten the attention of the powers that be and waves of resisters gained media attention as they fought property seizures or legal cases, some of which led to jail time. The Vietnam War era and the 1980s were particularly active. It seems we are too small a movement now to inspire a crackdown and thus more attention to the real issue. And the cuts to the IRS budget have over recent years have lowered the economic risks too.

I go from my IRS annoyance (and really, frustration that our resistance is largely ignored) to reading the stories from Myanmar of refusal to pay tax to the government-owned power company, among many other acts of economic resistance to the military rulers. The resistance has led to serious revenue shortfalls for the coup leaders, who have responded by sending soldiers into neighborhoods and homes demanding with guns pointed that people pay the tax. It’s quite an example of the power of tax refusal, though the consequences to the refuser may be dire.

I go from my IRS annoyance (and really, frustration that our resistance is largely ignored) to reading the stories from Myanmar of refusal to pay tax to the government-owned power company, among many other acts of economic resistance to the military rulers. The resistance has led to serious revenue shortfalls for the coup leaders, who have responded by sending soldiers into neighborhoods and homes demanding with guns pointed that people pay the tax. It’s quite an example of the power of tax refusal, though the consequences to the refuser may be dire.

Once again from the comfort of my home and well-fed life, I ask myself could I be like Dr. Wai Phyo Aung, 36, a Mandalay dentist quoted in the article, who has not paid his bill since the coup and says:

“If they come to my house and cut the electricity, I don’t care. I will never pay the bill. I don’t care even if they kill me. I won’t let my money kill citizens and feed the war dogs.”

— Post by Ruth Benn

Before I stopped paying for war . . .

“Fifty years ago, on a cold dark night

Several people were killed in a U.S. fight

There were few at the scene, but they all did agree

That the man who paid for it looked a lot like me”

(apologies to Danny Dill, Marijohn Wilkin, and Lefty Frizzell)

Ruth,

Thank you for the context of the US tax resistance within the wider global picture. There is a lot of comfort to exercise that resistance while many do not have that ‘privilege.’ It seems so important to squarely face the bullets that our tax dollars fund.

Your words and actions always inspire. Thank you Ruth!

Thanks Ruth. Please keep us posted. It is inspiring what some people do to refuse funding violence and oppression! May God grant all of us wisdom and courage.