How to Refuse to Pay for War

If you think more about your motivations for war tax resistance, it can help you to choose a way to get started. You can read about motivations or watch our 30-minute introductory film Death and Taxes or watch this webinar from 2021 with younger war tax resisters.

Other factors will influence your method of resistance also: whether you are salaried, self-employed, off-the-grid, below taxable income, etc.

But don’t let yourself get bogged down by too much weighing the options. You can always adjust your method as your resistance develops.

Methods of Resistance

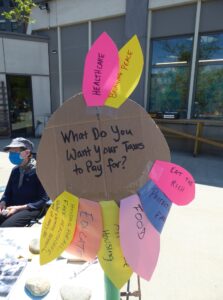

‘Flower Poll’ in Vermont. Tax Day 2021. Photo Courtesy of Lindsey Britt.

Summarized below are a few war tax resistance methods. Some are more convenient to some people

than to others. And some methods are better than others at meeting particular goals. Each method also has a different set of risks associated with it.

- File and refuse to pay your taxes. This involves filling out a 1040 form and refusing to pay either a token amount of your taxes (e.g. $5, $10, $50), or a percentage representing a “military” portion (see the federal spending pie chart), or the total amount (since a portion of whatever is paid goes to the military). See Filing and Refusing for steps to get started.

- Refuse to file a tax return. This might involve trying to stay out of the system or “off the grid.” See “To File or Not To File A Tax Return”

- Earn less than the taxable income. This can involve having such a low income that you are not required to file federal income tax returns (approximately $12,550 for a single person in 2021), or it can mean filing and taking deductions so that no income tax is owed. Note: Social Security taxes are owed on income of $600 and up. These taxes will be owed if you have not had them withheld at a job, and IRS collection is the same as for income taxes. See “Low Income/Simple Living as War Tax Resistance”

- Resist the local telephone excise tax. The federal telephone excise tax historically has been related to wars and excessive military spending. It appears on local-only landline phone bills. Refusing to pay this tax is a low risk method of war tax resistance. See Hang Up On War.

Legal Protest

If you are angry about endless war and military spending but are not ready to resist, don’t be silent. Here are some other options:

- Send a letter of protest with your 1040 tax form. Enclose it along with (but do not staple it to) your form. Send copies to your elected officials.

- Write letters to the editor protesting taxes for war, especially when people are thinking about taxes during tax filing season between January and April.

- Write a message of protest on the check you send with your tax forms.

- Pay the tax with hundreds of small-denomination checks or coins.

- Lobby for Peace Tax Fund legislation that would allow conscientious objectors to pay taxes to a fund that would not be used for military spending.

- Leaflet and protest before and on tax day.

- File “Part A” of the Peace Tax Return.

For more information see the book War Tax Resistance: A Guide to Withholding Your Support from the Military, or contact a war tax resistance counselor.

See also

- Risks and Consequences of each method

- Redirection — the bonus of resistance

- Frequently Asked Questions