The Case Against Anonymity, There Will Be Consequences

By Ed Hedemann

“The philosophers have only interpreted the world in various ways — the point however is to change it.”

—Karl Marx, 1845

“There’s a time when the operation of the machine becomes so odious … that you can’t take part. You can’t even passively take part. And you’ve got to put your bodies upon the gears … to make it stop. And you’ve got to indicate to the people who run it, … that unless you’re free, the machine will be prevented from working at all.”

— Mario Savio, 1964

Refusing to pay taxes to the IRS can be a solitary act, one in which no one but the refuser may be aware. Though money is denied the military, the potential for further outreach and additional pressure on the government is muted. I’m not content with personal witness. It’s not enough just to have none of my taxes go to the Pentagon then resting on those laurels. I want to be a thorn in the side of the government, maximize my burden on the system, and put my body on the gears of the war machine. I want to resist war, not simply refuse to pay for it.

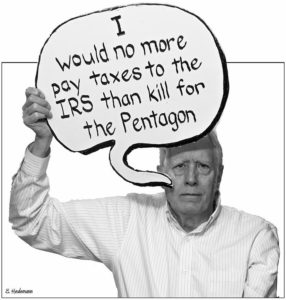

Ed Hedemann posted this self-portrait on Tax Day 2020 during the COVID-19 pandemic.

At times it seems as if refusing to pay taxes anonymously has become the war tax resistance movement’s version of “don’t ask, don’t tell.” While any method of refusal is certainly better than willingly turning one’s taxes over to the military, refusing anonymously does little towards advancing the cause.

That’s where confrontational resistance excels. We take advantage of an opportunity — rare outside the U.S. — to deny the government taxes for its wars, force them to acknowledge our opposition, goad them to change or at least react, all the while redirecting our taxes, grabbing the attention of our communities, broadcasting our message, and, possibly, inspiring others to join us.

Of course being confrontational may escalate the consequences, but can we really expect to achieve our vision of a warless world without a willingness to take chances? Besides being anonymous is no guarantee that you won’t be noticed by the IRS.

Despite the many methods, there are really only two primary approaches: refusal and resistance. That is, stopping the flow of money to the military through refusal of taxes by not filing, not communicating with IRS, earning under the taxable level, not hiding assets, and generally adopting an under-the-radar approach. Then there’s the in-your-face style of trying to be as visible as possible by filing and resisting, organizing others, setting up barriers to impede IRS collection, and publicly broadcasting far and wide the refusal to pay.

When I was younger, I was more of a purist. If the IRS seized even one dollar, it felt like a defeat. Though I still refuse all my federal income taxes and go out of my way to be uncollectible, I have since realized that the amount of money refused — and whether or not it’s ultimately collected — is secondary to the act of resistance itself. Now “failure” to me is not being able to resist.

I’d rather a thousand people each refuse $10 than just one person refuse $10,000. The amount of money is the same but the impact is far different. Besides, many who begin with $10 this year might increase that amount the next year. For first timers, it’s better to set the resistance bar at a less threatening level than to tell them that they have to refuse everything and change their lifestyle in order for it to be meaningful.

As with the spirit of the Haig quote,* I suspect that the government is less concerned with our refusal to pay taxes for war as long as we don’t trumpet it. If we keep reasonably quiet, especially those earning below the taxable level, then there is a tendency for the government to look the other way. But informing the IRS and, worse, publicizing it, makes it more intolerable, often forcing a reaction. One of the most unfortunate things about doing a protest is being ignored. War tax resistance provides an antidote to that.

Paraphrasing that observation about the weather attributed to Mark Twain,** many complain about military spending but few are willing to do anything about it. Carrying a “Cut Military Spending” sign isn’t really doing anything, but resorting to direct action by refusing to pay war taxes is.

If I were on the verge of earning just under the taxable level by year’s end and, consequently, in danger of not owing taxes, I would make sure that I earned at least a bit more — or even, if need be, artificially augment my income — so as to achieve a tax liability, thus giving me the opportunity to resist. Resistance is life. The government can deprive us of our money, our property, and even our freedom. But it cannot deprive us of our resistance. It cannot take away our ability to say “no” and force us to cooperate with the war machine. The one thing the government values more than our money is our acquiescence. I even hope to continue resisting after my death (see Zombie War Tax Resistance, below).

We have little enough time in life so I am not content to drift through it simply dealing with basic necessities, seeing a movie, having a pleasant meal out, relaxing on a beach vacation. I want to make a difference and have an impact. Refusing war taxes is a step towards that goal but resistance takes it a step further, standing up to the horrors and criminal ugliness perpetrated by often indifferent, and sometimes sadistic, military oppressors and oblivious, cynical government apparatchiks.

* “Let them march all they want, as long as they continue to pay their taxes.” (attributed to Secretary of State Alexander Haig, 1982)

** “Everybody talks about the weather, but nobody does anything about it.” (Mark Twain)

Zombie War Tax Resistance

Why concede the “death” part in that old saying about certainty? Why give the government a break from having to deal with your resistance when you die? What if there were a way to continue war tax resistance from the grave?

One possibility would be to fill out IRS 1040 forms for several years into the future. You can create your own returns by modifying the latest IRS form or download samples of future forms from the NWTRCC web site. Then fill them out however you’d like, sign, and future-date them. Put them into separate “forever”-stamped envelopes addressed to your local IRS, each with its own future-dated letter explaining your opposition to paying for war, then place a Post-It note on the outside indicating what year they are for. Arrange for a confederate to mail these sealed envelopes year after year every Tax Day.

Obviously, it would be helpful if no one informed the IRS that you died. Clearly, it would be good to make sure your estate and assets have been dispersed before this process of final resistance begins. Let the IRS fine, penalize, frivolousize you all they want, because you will be forever uncollectible but your resistance will continue to live on.

A Few Historical Examples

“Heroes” in our conformist society generally include millionaire ballplayers, movie stars, soldiers, police, and firefighters. However, what I find inspirational are those activists who have fearlessly challenged the establishment over the years (see below), as well as those who courageously oppose war by refusing to pay taxes even though they thought they were acting alone. While many of us prefer to wait for hundreds to get on board first, we need follow the example of the lone, outspoken, undaunted resister.

Ammon Hennacy was very public, frequently picketing the IRS over the years and sometimes not-so-gently pressing others to become resisters. Wally Nelson picketed every year on Tax Day with a sign reading “Haven’t Paid Taxes Since 1948.” Eroseanna Robinson noncooperated in court and in prison after refusing to turn over records to the IRS. Max Sandin staged a sit-in at the Treasury Dept. in Washington, D.C., to protest the seizure of his Social Security checks for unpaid taxes. Joan Baez held a press conference to announce her refusal to pay 60 percent of her income taxes. Gerald Walker assembled over 500 prominent writers and editors to appear in newspaper ads announcing their refusal. Lyle Snider claimed three billion dependents on his W-4 form. Martha Tranquilli listed six peace groups as “dependents” on her 1040 form. Karl Meyer filed 1040 returns every day for a year to protest the IRS’s then new fine against “frivolous” tax filings. Randy Kehler and Betsy Corner boldly took advantage of the IRS seizure of their house as an opportunity to call attention to the government’s obscene spending on wars. Bill Ramsey publicly violated a condition of his parole for a civil disobedience action by continuing refusing to pay taxes. As war tax refusers, the DC 7* — deliberate violators of the IR code — presented themselves for arrest (unsuccessfully) at IRS headquarters in Washington, D.C. Julia Butterfly Hill held a press conference to announce her refusal to pay $150,000 in income taxes.

* Robert Randall, Clare Hanrahan, Dan Lundquist, Judith Felker, Steve Magin, Carol Moore, and Bill O’Connell