NWTRCC friends and supporters,

Below is our press release for Tax Day, 15 July 2020. Feel free to adjust it for your own use. If you are having a tax day action, but have not alerted the NWTRCC office, please email the details to nwtrcc@nwtrcc.org, or use the online form. As stated in the press release, we are asking war tax resisters to make their presence felt on the streets (if possible) and online on July 15th. When posting online, please use the hashtags, #NoTaxes4War and #NWTRCC. Writing these “hashtags” with your message will mean that anyone can find your post on Facebook or Twitter by searching “#NoTaxes4War” or “#NWTRCC.” When posting a picture or graphic, also let folks know they can find out more info about WTR at nwtrcc.org.

In Resistance,

Lincoln

Press Release 2020

Tax Day 2020

For Immediate Release: July 9, 2020

National War Tax Resistance Coordinating Committee (NWTRCC)

Contact: Lincoln Rice, Coordinator

800-269-7464 (262-399-8217) or nwtrcc@nwtrcc.org

Tax Day Protests Demand End to the War on People of Color

Both Beyond and Within the Borders of the United States

Thousands of people across the United States—from San Diego to Manhattan—are organizing protest campaigns on or near Wednesday, July 15, calling for an end to endless war on people of color both inside and beyond the borders of the United States. In this past, local actions featured public hearings on an immoral budget, flying kites instead of drones, and “Burma shave” sign displays during rush hour. In light of the COVID-19 pandemic, many activists will adjust their plans. This year, plans include traditional protests at post offices and street corners, joining with Black Lives Matters protests to defund racist mechanisms of so-called security, and making their presence felt online by posting the call: “Don’t Pay for War!”—using the hashtags #NoTaxes4War and #NWTRCC.

War Tax Resisters will post this graphic online for Tax Day (July 15).

Or take a picture of themselves from protesting outside. Nydia Leaf in front of Post Office in New York City on 15 April 2020.

Many have been taking to the streets to call for Defunding the Police and redirecting those funds towards vital human needs. Since 1997, the Department of Defense has transferred more than $7 billion worth of military equipment to more than 8,000 law enforcement agencies around the country through what is known as the 1033 Program. The National Priorities Project has proposed a local resolution to end the transfer of military equipment to police. Additionally, since the mid-1990s, the Department of Justice has granted $14 billion to local police departments. NWTRCC Coordinator Lincoln Rice states, “The refusal to pay federal income taxes is a tangible way to protest the racist practices of local police departments and defund the police.”

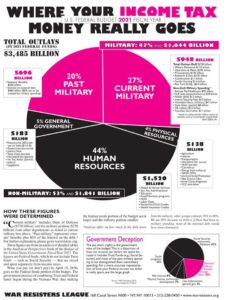

“Where You Income Tax Money Really Goes” War Resister League Pie Chart

This is all in addition to increased funding for the militarized Custom and Border Protection (CBP) and Immigration and Customs Enforcement (ICE), which terrorize our immigrant communities with raids and inhumanely separate families.

The proposed federal budget for fiscal year 2021 aims to take our country in the wrong direction. Noticeably missing in Trump’s $3.5 trillion proposed budget is any mention of funding to combat climate change. The Environmental Protection Agency would face a 26% decrease in funding with 50 programs facing elimination. This is worsened by the fact the U.S. military is the number one institutional user of oil in the world, burning about 240,000 barrels of oil each day. The U.S. military can afford to exert this environmental harm because approximately 50% of federal income taxes are directed to past, present, and future military spending.

This massive proposed budget also includes about $2 trillion in cuts to safety net programs like Medicaid, student loan programs, federal housing assistance, food stamps, and federal disability insurance.

Often forgotten is the growing use of drone warfare. According the Bureau of Investigative Journalism, there were 1,878 drone strikes during Obama’s eight years in office. During Trump’s first three years in office, there have been 11,760 drone strikes. Since 2002, there have been 8,850 to 16,800 drone deaths, including 900 to 2,200 civilian deaths.

The explicit focus of federal income taxes being utilized for the killing of human beings and the destruction of the environment while programs to address human needs face steep cuts is unacceptable.

Not waiting for the government to act, many activists will openly refuse to pay their taxes to the IRS and will instead redirect those funds to humanitarian programs. Bill Glassmire of Corvallis, Oregon, says, “I am resisting war taxes in order to redirect resources away from U.S. militarism and routine violence and toward building a peaceful and healthy earth.”

In Berkeley, California this past April, members of Northern California People’s Life Fund redirected $21,850 in resisted war taxes to eleven local social justice organizations that are providing human services that the government is not adequately supplying. On July 15, they will be granting an additional $12,000 to community based groups and individuals who are leading the movement for racial justice and divesting from police violence, as well as those who are addressing the COVID crisis through powerful mutual aid projects. The group was founded by war tax resisters in 1971 to pool their resisted war taxes. People’s Life Fund member Susan Quinlan says, “There are so many excellent groups that are working to protect families, communities, and the natural environment, and we are delighted to support these efforts. With U.S. military spending surpassing $1 trillion, we invite others to imagine what good could come from redirecting these military funds on a grand scale.”

In Berkeley, California this past April, members of Northern California People’s Life Fund redirected $21,850 in resisted war taxes to eleven local social justice organizations that are providing human services that the government is not adequately supplying. On July 15, they will be granting an additional $12,000 to community based groups and individuals who are leading the movement for racial justice and divesting from police violence, as well as those who are addressing the COVID crisis through powerful mutual aid projects. The group was founded by war tax resisters in 1971 to pool their resisted war taxes. People’s Life Fund member Susan Quinlan says, “There are so many excellent groups that are working to protect families, communities, and the natural environment, and we are delighted to support these efforts. With U.S. military spending surpassing $1 trillion, we invite others to imagine what good could come from redirecting these military funds on a grand scale.”

On Saturday July 11, the Cleveland Nonviolence Network will be hosting an online event, The Deadly Sonic Boom of the U.S. Military Budget, featuring war tax resister Kathy Kelly from Voices for Creative Nonviolence. Kelly will share from her life experiences traveling to areas impacted by war, conveying the personal impacts of war, and discussing our collective responsibility in terms of U.S. military spending.

The National War Tax Resistance Coordinating Committee (NWTRCC) has coordinated tax day actions since 1983. NWTRCC is a coalition of local, regional and national groups providing information and support to people who are conscientious objectors to paying taxes for war. NWTRCC partners with the Global Days of Action on Military Spending coordinated from Barcelona, Spain to join protests of war spending in the U.S. with a demand for global disarmament and a shift in priorities to sustainable development.

– 30 –

Resources:

War tax resisters are available for interviews. Please contact NWTRCC, 1-800-269-7464, nwtrcc@nwtrcc.org, for contacts in your area.

“Where Your Income Tax Money Really Goes” — War Resisters League pie chart, https://www.warresisters.org/resources/wrl-pie-chart-flyers-where-your-income-tax-money-really-goes

“The Financial Priorities of Local Governments Mirror the Federal Government” — NWTRCC article on the dominance of “security funding” in the federal budget and municipal budgets, https://nwtrcc.org/2020/06/04/the-financial-priorities-of-local-governments-mirror-the-federal-government/

Global Day of Action on Military Spending, http://demilitarize.org/

The Bureau of Investigative Journalism — Drone Warfare

https://www.thebureauinvestigates.com/projects/drone-war

Tax Day Report of 2019: https://nwtrcc.org/tax-day-2019/